I think CLR shows it best in their "EUR" slides which they generally show in their corporate presentations. The latest presentation is at this link.

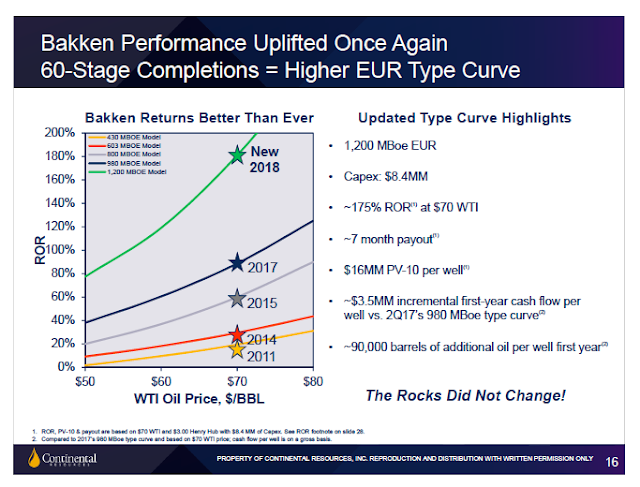

The "EUR graph" from the September, 2018, presentation:

I'll correct this if I find I'm wrong, but it appears the 21xxx permits were drilled in the 2012 time-frame. If so, look at the EUR line back in 2011 and then in 2014 in the graphic above.

I think most readers remember when we started out in the Bakken -- we were looking at EURs of 375,000.

I think a lot of folks thought Mike Filloon was nuts when he was suggesting 1 million bbls will be the next EUR milestone and that was years ago.

In the graphic above, Harold Hamm is shooting for EURs of 1.2 million boe in the Bakken. Early production in the Bakken is 94% crude oil; as time goes on, the percent of crude oil declines a bit but not by much.

Let's check the Bakken dashboard for October, 2018 (a pdf will download):

- natural gas production: 25 hundred million cubic feet/day = 420,000 boepd

- crude oil production: 1,300 thousand bopd = 1,300,000 bopd

- total = 1,716,600 boepd

- 420,000 / 1,716,600 = 0.24 or 24%.

- Let's look at the last Director's Cut, data for August, 2018:

- crude oil: 1,291,496 bopd (new all-time high)

- natural gas: 406,226 boepd

- total:1,697,721 boepd

- 406,226 / 1,697,721 = 24%

Later: see first comment regarding natural gas and energy / cash equivalence factors ---

6 MCF/bbl is an energy equivalence factor. It might be more appropriate to use a value equivalence factor to account for the current oil and gas prices. A factor of 20-25 MCF/bbl would yield around 100,000 boepd for the gas production.And then see my reply.

6 MCF/bbl is an energy equivalence factor. It might be more appropriate to use a value equivalence factor to account for the current oil and gas prices. A factor of 20-25 MCF/bbl would yield around 100,000 boepd for the gas production.

ReplyDeleteThank you. You are so correct. I've thought about that often -- the energy equivalence vs the value ($$$) equivalence. That's why NG (at least for me) is so incredibly to follow / factor / figure.

DeleteI'll continue to use the energy equivalence factor if not otherwise specified. The value equivalence factor will be a huge factor if the price of NG spikes this winter.