I've always said it's a fool's errand to predict the price of oil. I try very hard not to predict prices, but I often succumb. I digress. Here's one fool who tried betting on the price of oil. From Bloomberg:

Andy Hall, the oil trader sometimes known in markets as “God,” is closing down his main hedge fund after big losses in the first half of the year.

The capitulation of one of the best-known figures in the commodities industry comes after muted oil prices wrong-footed traders from Goldman Sachs Group Inc. to BP Plc’s in-house trading unit. Hall’s flagship Astenbeck Master Commodities Fund II lost almost 30 percent through June.

Hall shot to fame during the global financial crisis when Citigroup Inc. revealed that, in a single year, he pocketed $100 million trading oil for the U.S. bank. His career stretches back to the 1970s and includes stints at BP and legendary trading house Phibro Energy Inc., where he was chief executive officer.

“Andy Hall is one of the grandees of oil trading,” said Jorge Montepeque, a senior vice president of trading at Italian energy major Eni SpA.

Hall is the latest high-profile commodity hedge-fund manager to succumb to the industry’s low volatility and lack of trending markets. At least 10 asset managers in natural resources have closed since 2012. Goldman Sachs reported its worst-ever result trading commodities in the second quarter. [One reader of the blog frequently suggested GS was often talking its own book, seemingly trying to move the market for its benefit, not necessarily the benefit of the customer.]

Oil hedge funds such as Astenbeck wagered earlier this year that production cuts led by Saudi Arabia and Russia would send prices climbing. Yet, their bets backfired as U.S. shale producers boosted output and Libya and Nigeria recovered from outages caused by domestic disturbances and civil war. [And the fact that Saudi Arabia simply emptied some of its above-ground storage and never did cut exports -- until recently?]

The Apple Page

Updates

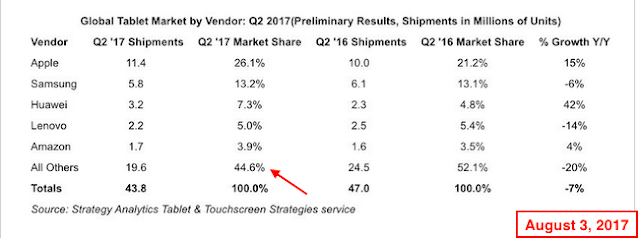

Later, 7:10 p.m. Central Time: see comments. Microsoft considers its Surface to be a "laptop" and not a "tablet" according to the TV commercial preceding the NFL's opening Thursday Night Football game, August 3, 2017, in Canton, Ohio.

Original Post

Note, the top five tablet companies account for 56% of all units shipped, and Amazon, #5, accounts for less than 4%. What companies can possibly account for the other 44% of units shipped?

**********************

The Apple Watch

One of my favorite Apple Watch posts was from March 9, 2015. If folks have followed the Apple Watch story, they know that analysts were unimpressed with the Apple Watch when it was first unveiled. So, how has it done?

From Macrumors:

Apple shipped an estimated 2.8 million Apple Watch units in the June quarter, an increase of 56 percent from an estimated 1.8 million shipments in the year-ago quarter.

"Sales of Apple Watch were up over 50 percent in the June quarter," said Cook. "It's the number one selling smartwatch in the world by a very wide margin."I particularly liked the graphic I put together using a couple of Apple graphics:

*******************************

AirPods

Severely constrained ... and selling for $159.

From Macrumors:

During today's earnings call covering the third fiscal quarter of 2017, Apple CEO Tim Cook briefly mentioned the company's super popular hard-to-come-by wireless earphones, the AirPods.

According to Cook, production capacity has been bumped up, but because of the high level of demand, Apple is still unable to make enough to reach supply/demand balance.

We're also seeing incredible enthusiasm for AirPods. 98 percent customer satisfaction based on Creative Strategy's survey. We have increased production capacity for AirPods and are working very hard to get them to customers as quickly as we can, but we are still not able to meet the strong level of demand.Priced at $159, Apple's AirPods are wire-free earphones that feature Bluetooth and an Apple-designed W1 chip for a better connection and simple transfers between different devices. AirPods are equipped with an infrared sensor to detect when they're in the ear, and they support a range of touch-based gestures.

No comments:

Post a Comment