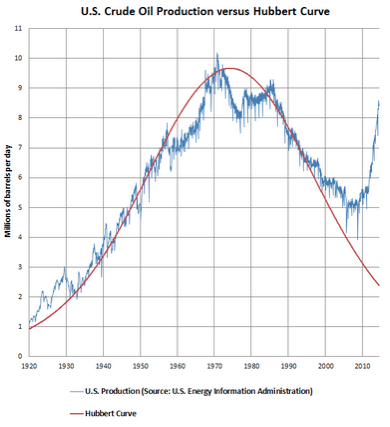

But, like global warming, the discussion on Peak Oil is closed.

And now there's so much oil being produced, the oil industry is voluntarily cutting back production -- because the price is too low.

*************************************

Gasoline Prices Here And There, Then And Now

From the March 10, 2015, EIA report (a dynamic link):

U.S. average regular gasoline retail prices have increased for six consecutive weeks to $2.49/gal as of March 9, after falling to $2.04/gal on January 26, the lowest price in EIA's weekly survey of Monday prices since April 6, 2009. Rising crude oil prices, along with several outages at refineries on the West Coast, have contributed to the recent increase in retail gasoline prices.Meanwhile, in California, self-proclaimed watchdogs are asserting that the industry is orchestrating the increase in gasoline prices in California. KION is reporting:

In February, monthly average regional gasoline retail prices ranged from a low of $1.96/gal in Petroleum Administration for Defense District (PADD) 4, the Rocky Mountain region, to a high of $2.55/gal in PADD 5 along the West Coast. EIA expects U.S. retail gasoline prices to average $2.26/gal during the first quarter of 2015 and $2.39/gal for the full year, $0.13/gal and $0.05/gal higher than in last month's STEO, respectively.

A consumer watchdog report says California oil refineries have about half as much gasoline on hand compared to the rest of the country. Tuesday a consumer advocate told a Senate committee the situation has lead to a spike in gasoline prices for Californians.In other news, California environmentalists want California refineries shut down. LOL. This suggests there may be a knowledge deficit for Jay Leno's jaywalkers -- it appears Jay Leno's jaywalkers are not aware of what those big "things" do that sit between oil wells and service stations.

They say when refineries go down, gasoline prices go up. And California is the worst case scenario.

The report further explains how Californians paid $47 billion extra, or $13 million per day more for gasoline compared to the rest of America over the last ten years.

Jamie Court, President of Consumer Watchdog says, "There is about an .84 difference in gas prices with the rest of America right now. Crude oil costs the same in California. This is really oil companies making big profits. The Senate committee agrees with our report that all of this extra money, the .84 per gallon is going right back into the pockets of the oil refinery and this committee is going to be discussing what can we do to change that."

Court says his group and other advocates plan to urge the governor and the Legislature to require oil refiners to keep another week of gasoline inventory on hand to avoid gasoline price spikes in the third largest gasoline consuming economy in the world.

Court was asked what he'd do to change the status quo, " First of all, we don't have enough real time information. We did a report showing that over 10 years we've had about 10.7 days worth of supply on hand in California compared to 18 in America. So we have always been behind in supplies. So we need real time data about when refineries go down and why. And we need information as to what days the supply is on hand, that's transparency."

this post is a joke, right?

ReplyDeleteanybody who would invest in US or Canada oil energy right now would be foolish. the reason why is that the Saudis are developing a hybrid oil extracting system. they are in a unique position to control oil prices. it is obvious. they are hiring fracking talent let go in the US due to the oil price drop. all those wells just sitting there will be dismantled and shipped to Saudi Arabia, something is better than nothing, otherwise they will just rust out there. probably at rock bottom prices after the US companies purchased that material at a premium. we are actually paying for Saudis Arabia fracking industry. dirty underhanded trick, but then again that is free enterprise. they will relocate all the US wells at their's in Saudi Arabia that have been empty for decades. where there is oil there is shale. all those well sitting there idle in the US hoping to restart are literally pipe dreaming. they will never start up again, they are going to Saudi Arabia, and once they have enough wells they will cut production from their conventional wells to drive up the price again to make their new fracking wells profitable. if any other country try to frack the Saudis will just over produce from their conventional wells, shut down their fracking wells and wait for the surplus well to go under again and repeat and repeat just like ping pong. why frack when they have loads of conventional oil? well we know now. this is the article from business insider which explains why Saudis are hydraulic fracking. http://www.businessinsider.com/saudi-arabia-wants-its-own-shale-gas-2015-1#ixzz3UrxsmHCh

ReplyDeleteYup.

DeleteDisclaimer: this is not an investment site. Do not make any investment, financial, or relationship decisions based on anything you read here or think you may have read here.

With regard to the Business Insider article linked above, read the article closely.